"Stare deeply at the Dow"

The price action of the major averages is eerily reminiscent of this time last year - down January, up February, down early March, then straight up through July. It's tempting to think that we are seeing a repeat. Worse yet, based upon lamestream headlines, one would be led to believe that it's deja vu all over again.

And then we remember that a few things have changed since last year:

Oil and commodities have collapsed

The dollar index has gained 25%

The Global Dow peaked last July and is at the same level it reached 15 months ago

Emerging Market currencies have been monkey hammered

24 global interest rate cuts year to date

Carry trades are getting monkey-hammered a la 1997

Deflation has spread globally

High Yield (Junk bonds) peaked in June

Gold is at a five year low

30 Year U.S. interest rates hit an all time low

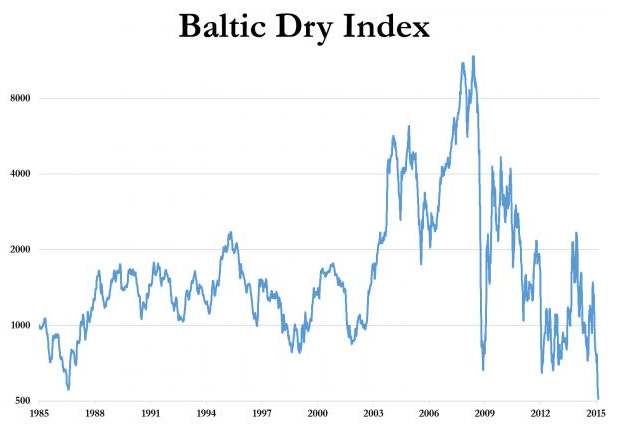

The Baltic Dry Index is at an all time low

Utilities, Energy, Construction, Industrial machinery sectors have all rolled over hard

Biotech and airlines went parabolic

Dow with price range of average stock. Not confirming the February top:

Distribution: Institutions selling to Etraders

Down Volume as Ratio of Total Volume

Bulk shipping costs

U.S. future deflation expectations. Visualized

30 Year Treasury Yields Since 1975:

Those believing the headline lies and bullshit have been sold down the river. Again.