ZH: Nov. 14, 2015

"Could the rally be over? Its possible. Though, if it is, it would be the outlier on the chart."

Comparing today's level of risks to any other time in the past, is a fool's errand of the highest order. The Idiocracy has convinced themselves beyond any doubt that they've successfully borrowed their way out of a debt crisis.

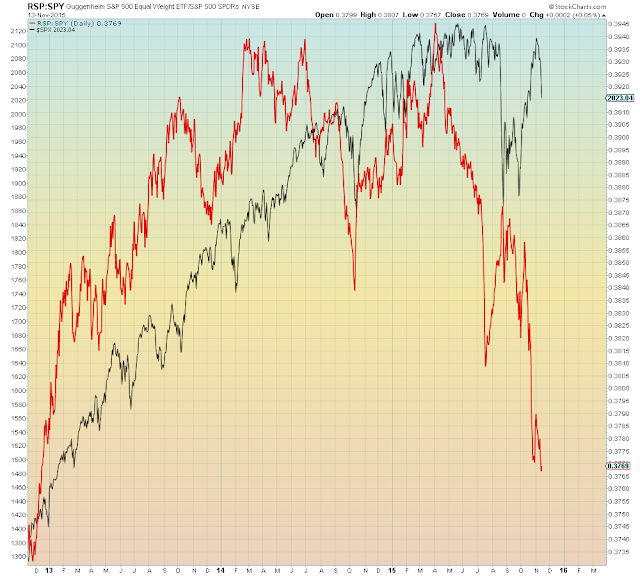

Below, just comparing this year's "crash" (-14%) to last October's crash (-10%), indicates the chasmic divergence:

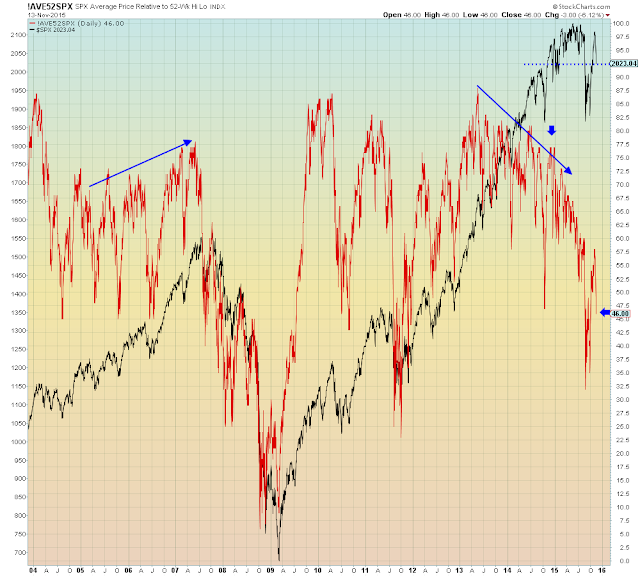

We see below that year-over-year, the market is back to roughly where it was a year ago, whereas internals (average stock, in red), now are BELOW where they were at the bottom of last year's crash. Large blue arrows show the relative positions:

Could this be 2011?

CasinoConomy suggests that's highly unlikely.

All sectors ex-internet peaked months and years ago:

Mining (2011). Transports (Nov. 2014). Energy (July 2014). Construction (Mar. 2104). Biotech (July 2015). Internet (Nov. 2015???)

The black vertical line shows where these key sectors were this time last year.

All sectors ex-internet peaked months and years ago:

Mining (2011). Transports (Nov. 2014). Energy (July 2014). Construction (Mar. 2104). Biotech (July 2015). Internet (Nov. 2015???)

The black vertical line shows where these key sectors were this time last year.

"This would be the shallowest rally ever". Really?

The Nasdaq 100 gained 35% in two months i.e. 515% annualized...There was never a re-test, there was just Wall Street covering shorts ahead of bonus season, all thanks to a bad jobs report...

NYSE Composite (average stock)

Tops are a process, followed by the shitting of bricks

Tops are a process, followed by the shitting of bricks

The exact same pundit two weeks ago

Someone needs to read their own articles...